– Introduction

Since the typical power plants use fossil fuels, it would not only expire soon but also cause environmental pollution. According to evaluations, the environmental pollution is 21.3 kilograms of various oxides, carbon, and carbon monoxide and 657 kilogram CO2 per megawatt-hour of generated energy using diesel fuel.

In recent years, wind power plants have been amazingly competitive with other power plants in an economical way, mainly due to the following:

- Increasing development of wind turbine technology has reduced the cost of the manufacturing process.

- The cost of designing wind turbines has decreased because of their standardization.

- The cost of operating wind turbines is low due to the lack of fossil fuels, their low amortization and for being automatic and is not comparable to the costs of operating thermal power plants.

- Due to the difficulty of wind turbines access for repairs and servicing, today we are trying to develop durable and desirable wind turbine components. It has reduced the cost of repairs and maintenance.

- Lack of environmental pollution

- Possibility to be constructed in remote areas and economical in comparison with other types of power plants, and the possibility of supplying wind turbines in hybrids with solar and diesel generators.

- Plentiful and permanent energy

Project Assumptions

| ردیف | شرح | مقدار | واحد |

| ۱ | تعداد توربین | ۱ | عدد |

| ۲ | ظرفیت هر توربین | ۷۱۰ | کیلو وات |

| ۳ | عمر مفید پروژه | ۲۰ | سال |

| ۴ | ضریب ظرفیت نیروگاه | ۴۰ | درصد |

| ۵ | مدت زمان واریز اولین واریز تا عقد قرارداد خرید برق تضمینی | ۶ | ماه |

| ۶ | مدت زمان بین عقد قرارداد خرید تضمینی با دولت تا شروع کار توربین | ۱۲ | ماه |

| ۷ | هزینههای (EPC) نیروگاه | — | میلیون ریال/کیلووات |

| ۸ | هزینۀ تملک زمین | — | ریال/ متر مربع |

| ۹ | مساحت زمین مورد نیاز | ۱۴ | متر مربع/کیلو وات |

| ۱۰ | هزینۀ تعمیر و نگهداری | ۲ | درصد هزینۀ سرمایهگذاری |

| ۱۱ | نرخ استهلاک سالانه توربینها | ۵ | درصد هزینۀ سرمایه استهلاکپذیر |

| ۱۲ | نرخ تنزیل | — | درصد |

| ۱۳ | سهم وام بانکی | — | درصد |

| ۱۴ | پذیرش طرح به عنوان وثایق برای وام بانکی | — | درصد |

| ۱۵ | حجم وثایق خارج از طرح برای وام بانکی | — | درصد |

| ۱۶ | قیمت خرید تضمینی برق | ۵۷۰۰ | ریال/کیلووات |

Explanation one: The average capacity factor of Iran’s proper sites is between 45% and 50%. This capacity factor is calculated from the turbine accessibility which determines how it operates, and the total loses.

Explanation two: The plant’s (EPC) cost is 49 million rials per kW, which includes Engineering, Purchasing, and Construction.

Explanation three: Customs exemptions, low cost of transit and transport and stuff insurance have significant advantages in supplying turbines from the interior.

Explanation four: Due to state assistance to renewable energy, the project has been exempted from tax for 10 years since its operation.

-Electricity purchase tariffs from wind power plants (project income prevision)

The output of the wind plant is just electricity which annual production with a nominal capacity is 2728850 kW from 1397 to 1416 for 20 years.

To calculate the amount of production associated with the nominal capacity, one turbine with the capacity of 710 kW for 8760 hours (365 days in 24 hours) with a total capacity ratio of 40% [1] is used.

| ردیف | اتلاف | درصد |

| ۱ | ترانسفورماتور توربین | ۱٫۴۰% |

| ۲ | ترانسفورماتور پست | ۰٫۶۰% |

| ۳ | کابل کشی | ۰٫۵۰% |

| جمع اتلافات شبکه برق | ۲٫۵۰% | |

| درآمد( میلیون تومان) | قیمت هر کیلو وات ساعت (تومان) | برق تحویلی به شبکه (مگاوات ساعت) | ضریب اتلافات شبکه | تولید برق سالانه (مگاوات ساعت) | تعداد ساعت | تعداد روز | ضریب ظرفیت | میزان تولید هر توربین(KW) | تعداد توربین | |

| ۱,۳۸۲ | ۵۷۰ | ۲,۴۲۵ | ۳% | ۲۴۸۷ | ۲۴ | ۳۶۵ | ۴۰% | ۷۱۰ | ۱ |

The electricity purchase tariffs for renewable and clean plants were announced by the Ministry of Energy in the field of renewable energy in May 1395 as follows. It is noted that tariffs are established until further notice and is the basis for contracting the private sector with the Ministry of Energy.

– In accordance with paragraph 4 of the said law, the electricity guaranteed purchase basis price of which constructing with technical, design and domestic production equipment increases up to the maximum of 30 percent in accordance with the provisions of the not to Article 6, of the Cabinet of Ministers’ Canon. Thus as respects, as the project’s turbine maker has succeeded in localizing the whole project inside the country and in accordance with the principled agreement between the project constructor and the SATBA, up to a maximum of 30%, to projects executed with SabaNiroo.

-The prominent feature of the proposed scheme by the Ministry of Energy is the increase in prices for each two-month billing period due to changes in the exchange rate (Euro) and retail prices of materials. This price increase (adjustment rate) will provide more guarantees and economic justification and reduce the risk of investment in different economic conditions. This parameter is calculated as 0.3 by the following equation with the alpha coefficient.

This adjustment rate is defined in order to reduce the investment risk with respect to possible exchange rate fluctuations as well as to account for inflation (in the average retail value of materials). It’s worth noting that the annual adjustment rate was based on the retail price at the beginning of the year, the average euro rate in the one-year period before payment and the retail price at the beginning of the year and the average exchange rate of the euro in the one-year period before the time of the contract.

Accessibility coefficient is an indicator that is calculated taking into account factors such as suitable location for installation, technical specifications of power plant wind turbines, access to transmission lines, land prices and environmental issues.

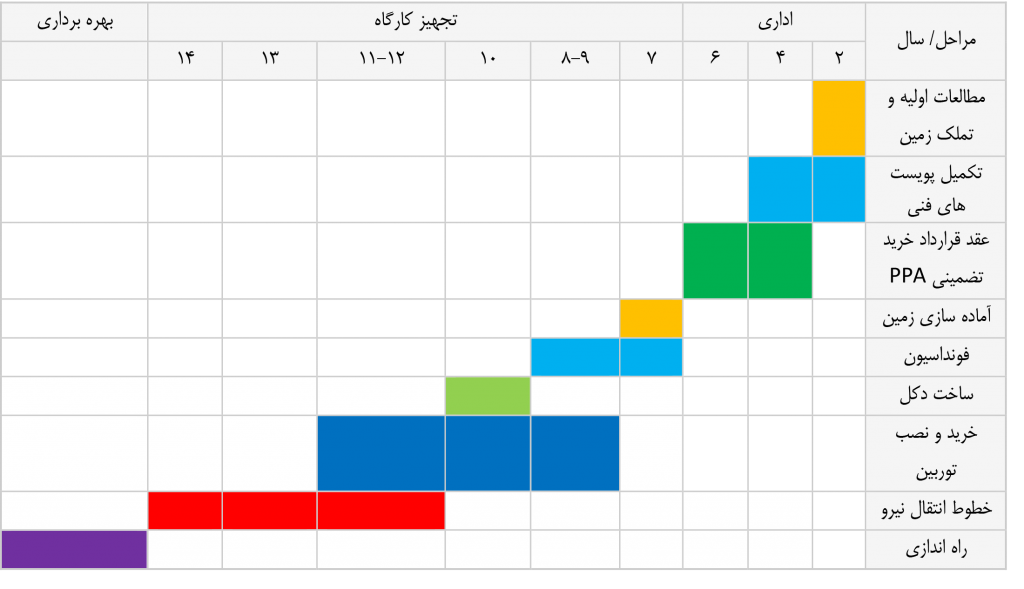

- Scheduling the implementation of wind power plant projects

In order to implement the project in a coordinated, regular and continuous manner, it is necessary for each executive operation such as obtaining necessary permits and contracts, purchasing and preparing land, construction and landscaping, ordering, purchasing and equipping hotels, facilities, hiring and Staff training, pilot operation, unforeseen delays, etc., a specific timetable. According to the information obtained from the Scheduling Engineers, the following is provided:

Scheduling Table

The project schedule is from the time of the contract with the corporate until the construction and operation phase.

The offer of investment on a 2500 kW from Mapna Group Company in Khaf district with an investment of 5 billion riyals and the acquisition of 12 billion rials and a return on investment of 30 percent.